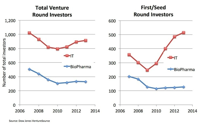

The ever-shrinking number of biotech venture capital firms was a common refrain during the 2008-2012 period; it’s true that a large number of firms went under, closed their doors for new investments, or moved into zombie status. I wrote on the subject back in July 2012 (here). The biotech investing environment then, with a relatively bleak IPO landscape and venture funding off some 40% from the prior year, was very different from the past two years with an “open” IPO window and steady pace of venture funding.